The Board of Commissioners (the "Board") of Fort Bend County Emergency Services District No. 7 (“FBCESD 7”, or the "District") has called for a Sales and Use Tax proposition to be on the election ballot for Tuesday, November 7, 2023. If approved by voters, this proposition would authorize up to one percent (1%) in any location in the district. Texas Health & Safety Code Section 775.0751 says the district may impose the tax at a rate from one-eighth of one percent to two percent in increments of one-eighth of one percent. If the proposition passes, the funds will be used for the implementation of Advanced Life Support measures, and to address the rapid population and commercial growth in the area.

What is Fort Bend County Emergency Service District No.7?

An Emergency Services District (ESD) is a grass-roots government entity created by voters in an area to fund fire protection, emergency medical services, or both. More than 300 districts are operating in Texas, and more are added at nearly every uniform election date.

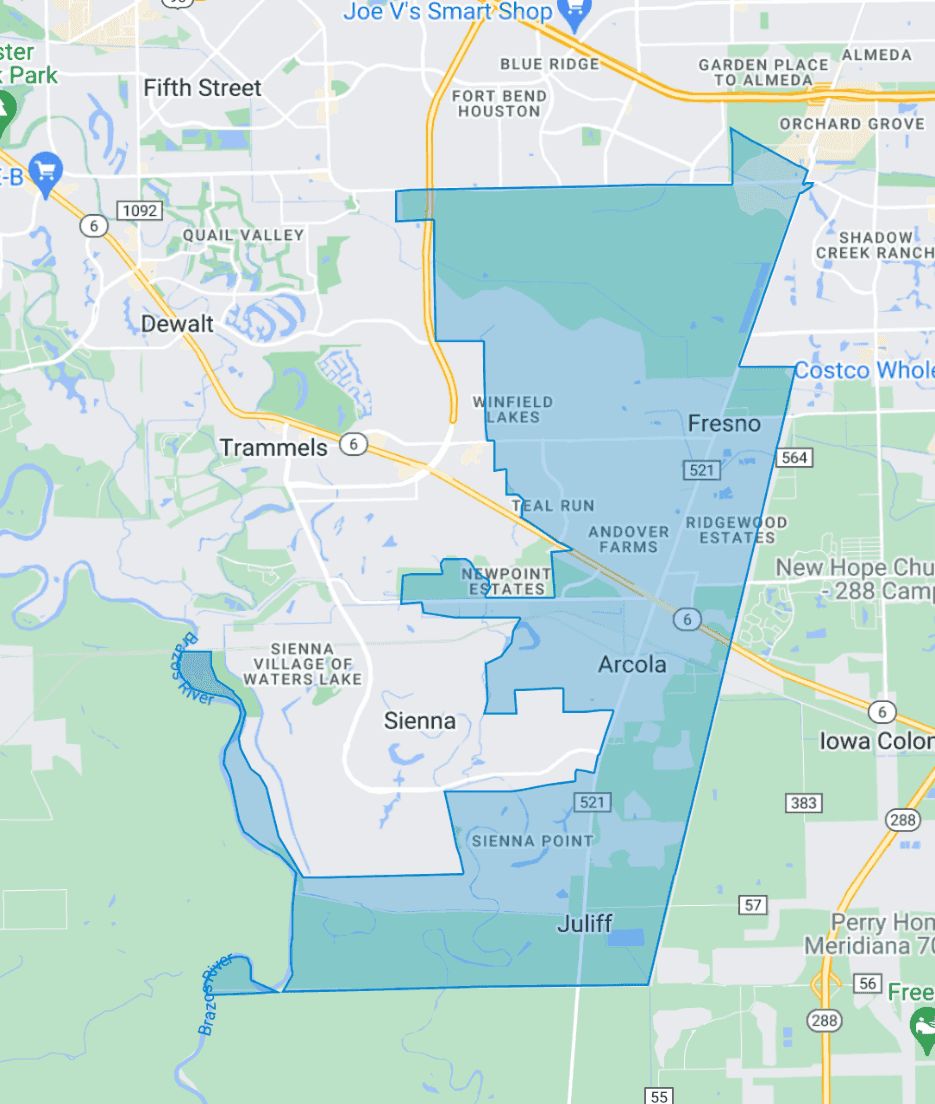

Fort Bend County Emergency Services District No. 7 is a government entity that collects property tax to fund providing fire suppression and emergency medical services to the residents within the district’s boundaries, and to neighboring reciprocal, automatic aid partners as needed. These taxes fund stations, apparatus, personnel, and equipment the fire department utilizes to provide fire protection for the community. The District operates as Fort Bend County Emergency Services District No. 7 (FBCESD 7), Fresno Fire and Rescue, and as a combination department. The Board of Directors coordinates with department command staff and administration to manage the funding, fiscal health, personnel, and apparatus the department uses and maintains in daily operations.

The main taxes collected from the District come from an ad valorem tax, commonly known as property tax. Emergency Services Districts are capped by the Texas Constitution at a rate that cannot exceed $0.10/$100 valuation of taxable property. Currently, FBCESD 7 2023 total tax rate is set to the state maximum at $0.10/$100. Often, this revenue source alone cannot meet the demands and the emergency response needs of districts. This is why boards may seek additional funding outside of property taxes.

Why does the district need more funding?

Through fiscal management, the Board of Commissioners of FBCESD 7 has been able to maintain the current training, apparatus, and equipment to protect the community with their current tax rate up to this point while steadily growing a strong capital reserve for scheduled, long-term capital expenditures like stations and new apparatus, personnel training, and response equipment. However, there are a few key issues facing the District which require additional funding:

- Advanced life support (ALS) implementation to include LUCAS devices and additional priority medical response equipment

- Need for an additional station, including staffing and implementation of a rapid medical response team by 2025

- Enhanced cancer screening and prevention measures for first responder staff

As the Board considers the next five (5) years of growth and emergency response, long-term strategic goals have been outlined below in anticipating the needs and growth of the district.

What are the issues facing the district?

FBCESD 7 has seen tremendous population and commercial growth over the past decade, especially in the southern coverage area. Because of this growth, the number of calls the district has responded to has increased over the last 10 years. FBCESD 7 has been using the district’s capital reserves to forecast and plan for equipment purchases and maintenance for the foreseeable future, as increased costs for apparatus and longer lead times require more expenditure than in previous years. The average lead time for some apparatus is three (3) to four (4) years.

Why a Sales Tax?

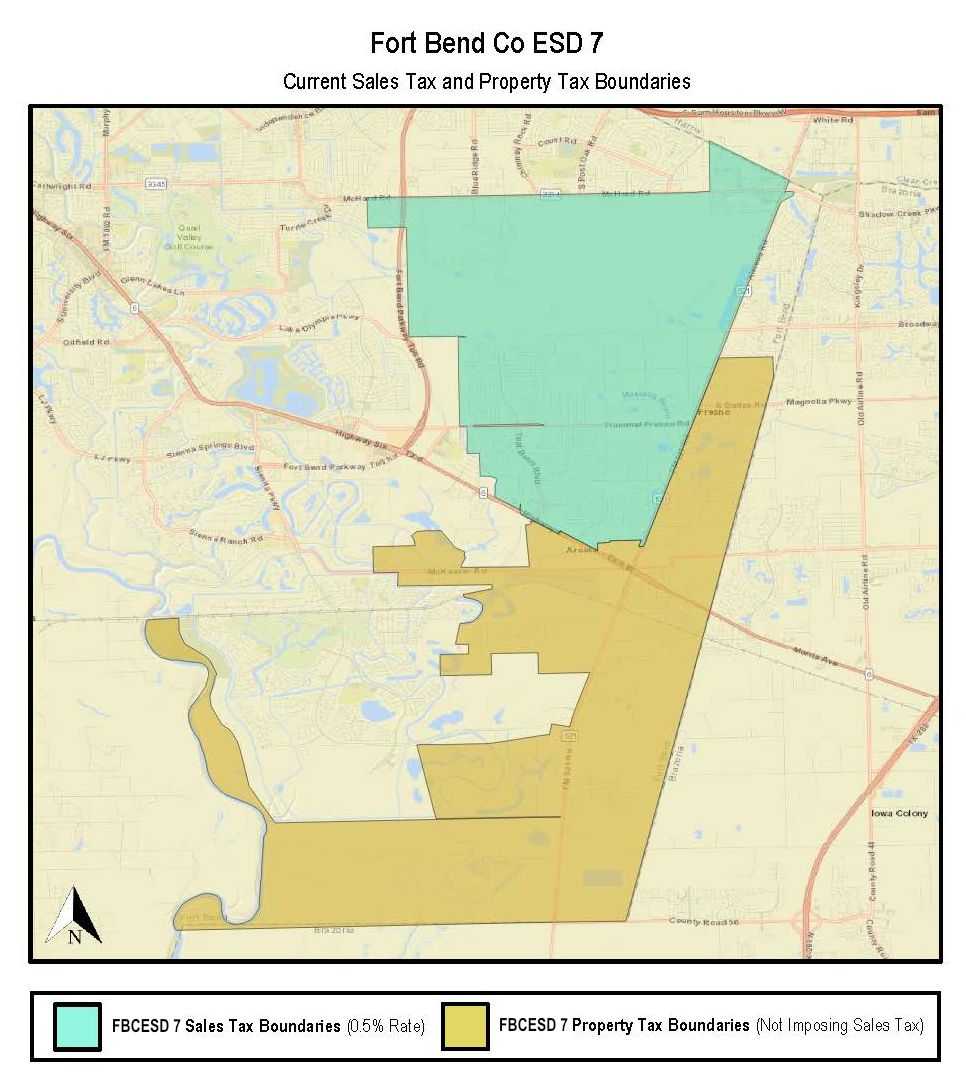

By levying a Sales and Use Tax, FBCESD 7 would be shifting a portion of the funding for emergency services from property owners to anyone buying taxable goods and services in the district. The District’s 2023 adopted property tax rate is $0.10/$100 valuation. The district is unable to increase the property tax rate beyond the state-allowed maximum rate, thus the Board of Commissioners has chosen to seek additional funding through sales tax.

The Board of Commissioners has considered several sources of additional funding and the best option would be the implementation of a sales and use tax in the district. In Texas, the state captures $0.0625 (6.25%) on every dollar spent but allows other local government entities to capture up to $.02 (2%), with a state maximum of $0.0825 (8.25%), to support community services. If the District levied up to one percent (1%) Sales and Use Tax, it could supplement the existing funding of emergency services from solely depending on residents’ property taxes to those people traveling to and through the FBCESD 7 community, who may also use and benefit from local emergency services. Lastly, by only capturing 1% of the available 2%, FBCESD 7 acknowledges and supports Fort Bend County having the option, down the road, to place an additional county assistance district (CAD) overlay on the southern part of the District to fund local initiatives.

What Happens If the Sales Tax Proposition Fails?

Whether or not the sales and use tax measure passes, the FBCESD 7 Board of Commissioners will continue to serve the residents within the district boundaries, but their ability to address the issues facing the district’s growth requirements and staffing goals would be hindered, as outlined above.

What Will the Ballot Look Like?

The November 7, 2023 ballot will ask residents of the district to vote for or against a Local Sales and Use Tax, for the entity known as Fort Bend County Emergency Services District No. 7. It will read as follows:

Proposition:

“The adoption of an increased local sales and use tax in Fort Bend County Emergency Services District No. 7 at a rate not to exceed one percent in any location in the district.”

Voters will need to be looking for this language if they wish to cast their vote regarding the sales and use tax for FBCESD 7.

When, where, and how can I vote?

Voting schedules and locations for the November 7, 2023 election can be found at this official Fort Bend County website www.fortbendcountytx.gov/government/departments/elections-voter-registration/early-voting-schedulepolling-locations.

Use this link to find information on registering to vote:

www.fortbendcountytx.gov/government/departments/elections-voter-registration/voter-registration

I have more questions…

Good! The goal is for the residents to have all the information at their disposal when voting approaches. Additional questions can be fielded through the “Contact Us” form on the District’s website: www.fresnofiretx.com/contact-us